When Mayor John G. Ducey took office on January 1, 2014, he made bringing fiscal conservatism to town hall his top priority. The previous decades had been marked by explosive growth in both municipal spending and taxes. Through the implementation of cost saving measures and policies and a dedication to fiscal prudency, the Ducey administration has succeeded in slowing that growth and making town hall more fiscally conservative and making our long term financial outlook stronger.

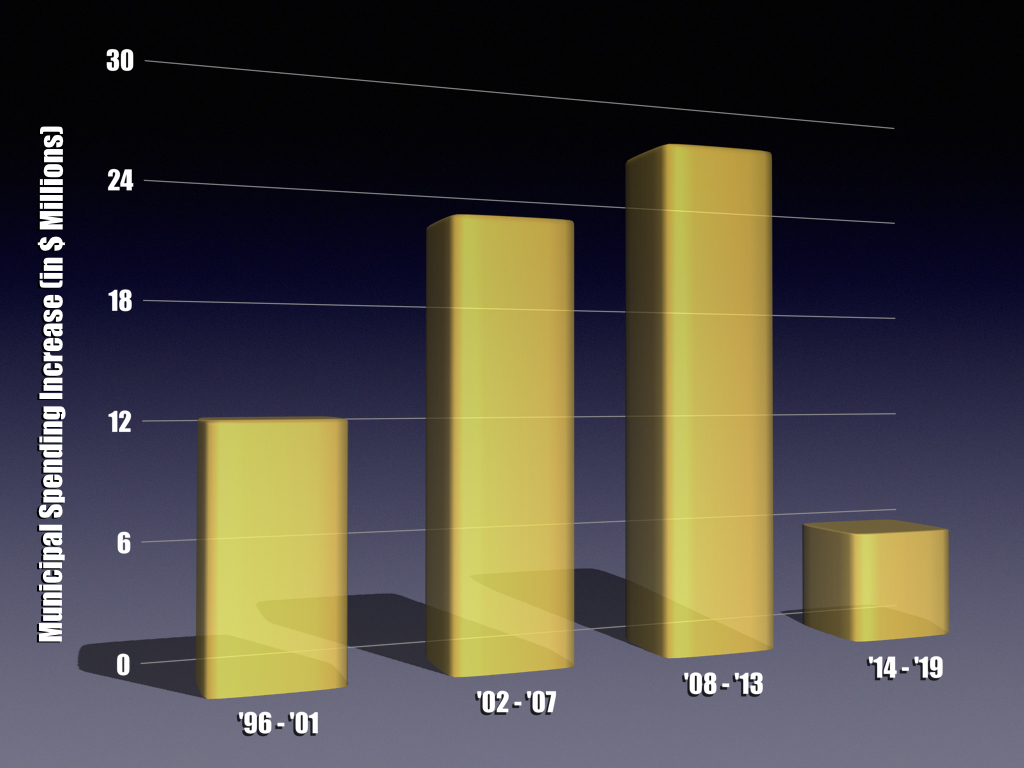

Spending Growth Historically Low Under Mayor Ducey

In the ten budgets prior to the commencement of Mayor Ducey’s administration, the municipal budget had grown $41,371,989 – a total growth of over 72%. This is an average of over $4.1 million a year.

The total spending growth over the first six budgets of Mayor Ducey’s administration has been $5,791,083. This is a total growth of roughly 5.9% and an average of roughly $960,000 per year. The average annual increase under Mayor Ducey is 77% smaller than the average increase of the previous decade.

Mayor Ducey’s six-year spending growth is lower than previous six-year periods by a wide margin. From 1996-2001, the spending growth was $12,229,052, or 32%. From 2002-2007, spending growth was $21,936,538 or 43%. From 2008-2013, spending growth was $26,107,907 or 36%. Again, spending growth under Mayor Ducey has been under $6 million for a total of 5.9%.

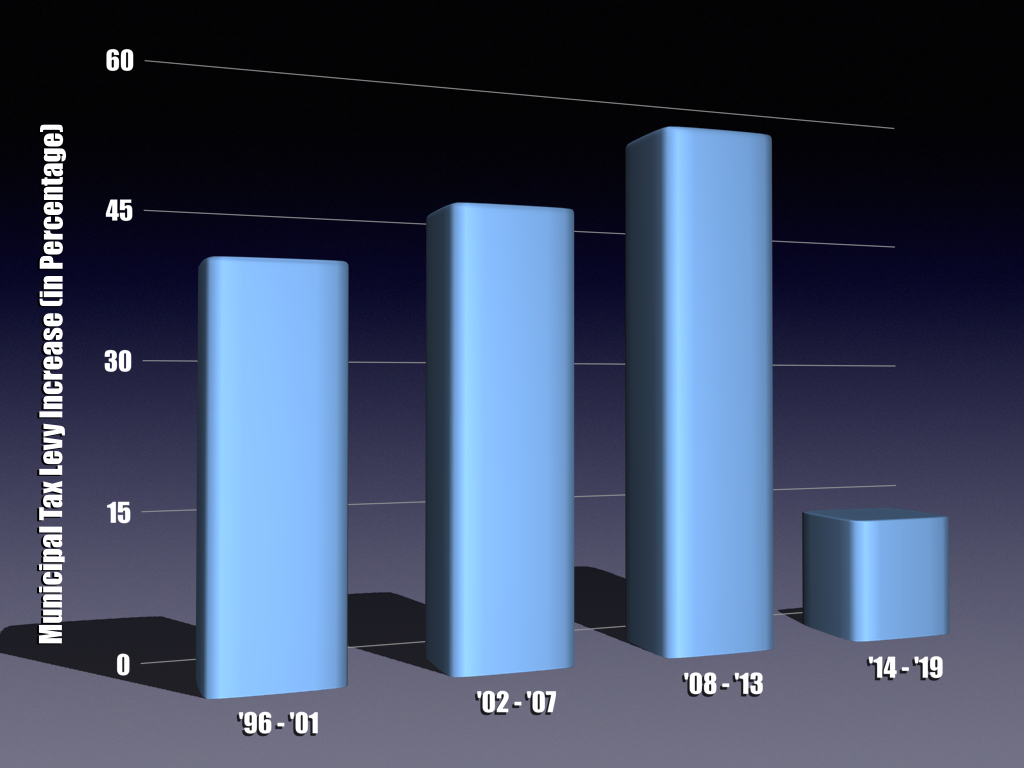

Municipal Tax Increases Stabilizing

Another priority for the Ducey administration has stabilizing the growth of the municipal tax levy. The tax levy is the amount of property tax dollars used to fund the municipal budget. In the ten years prior to Mayor Ducey taking office, the municipal tax levy increased $30,640,293 – an increase of 89.38%!

Over Mayor Ducey’s six budgets, the tax levy has increased $8.8 million or roughly 13%. This is an average of about $1.4 million a year. The average growth of the previous decade was $3.06 million per year.

As with spending, the municipal taxes growth over Mayor Ducey’s six budgets is lower than previous six-year periods. From 1996-2001, the total tax levy growth was $8,178,615. While the dollar total is lower, it represented a 39% increase. From 2002-2007, the levy grew $13,274,227 or 45%. From 2008-2013, the levy grew $22,667,566 or 54%. The average annual levy increase in the six-years prior to Mayor Ducey taking office was over $3.7 million.

Township Debt Going Down

Another fiscal priority for Mayor Ducey has been the reduction of the township’s outstanding debt. When he took office on January 1, 2014, the township’s debt was $168,335,337. A decade before that – January 1, 2004 – the debt was $82,066,468. That is an increase of 105% from 2004 through the end of 2013.

Over the past six years, the township’s net debt has been lowered by $23 million – a reduction of 13%. The township is on track to reduce that debt another $3 million this year which would bring the total reduction in debt to over $26 million. This would be a 15.3% reduction from when Mayor Ducey took office.

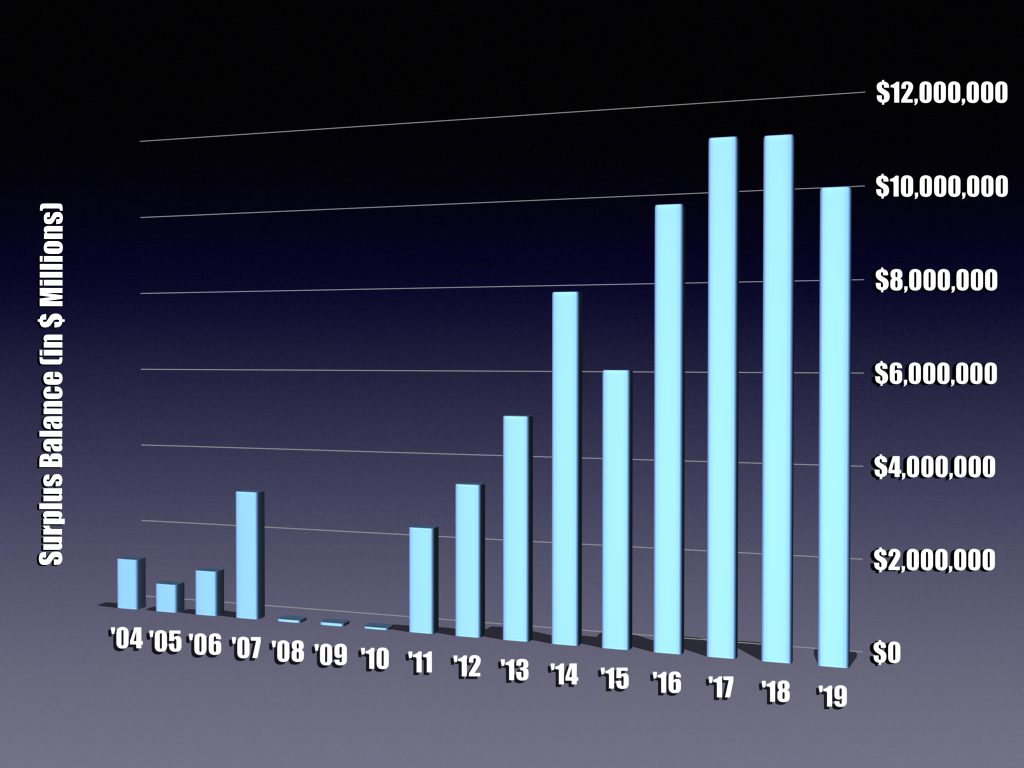

Township's Surplus Restored to Healthy Levels

One of the financial achievements of Mayor Ducey has been the restoration of the township surplus. A healthy surplus is indicative of the fiscal strength of a municipality.

The 2019 municipal budget leaves a surplus balance of $9,808,334. The budget utilized $8,546,712 as revenue. Over the past six budgets, the average surplus balance has been $9,188,033.

When Mayor Ducey joined the Township Council in 2012, he and his colleagues in the new Council majority changed the township’s use of surplus. In the eight budgets prior to the 2011 budget, the township had virtually depleted the surplus to offset tax increases. From 2004 until 2011, the average surplus balance was $1,090,449. In 2010, the surplus balance was $48,724 and in the average balance from 2008-2010 was only $59,681.

Over the past six budgets, the township has utilized 51% of the available total surplus. From 2004-2011, the township used roughly 90% of the available surplus.